Tech Tips

MARCH TECH TIP

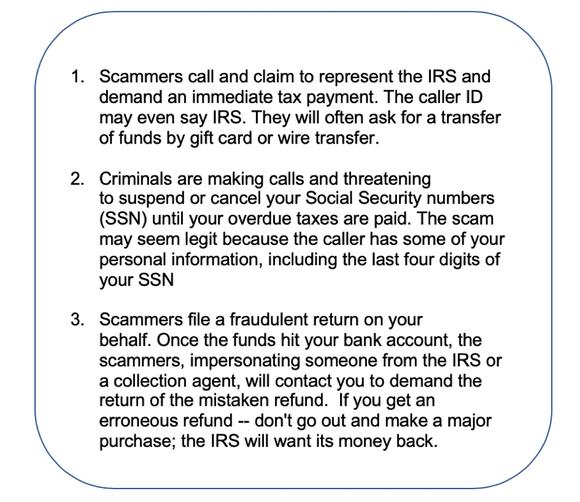

It’s tax season so the March Tech Tip focuses on tax scams. From phony IRS calls demanding gift card payments to threats of canceling your Social Security number. Remember the IRS will not call or email you for payment without sending a letter first. Don’t fall victim and learn how to spot a scam and learn what to do!

It’s tax season so the March Tech Tip focuses on tax scams. From phony IRS calls demanding gift card payments to threats of canceling your Social Security number. Remember the IRS will not call or email you for payment without sending a letter first. Don’t fall victim and learn how to spot a scam and learn what to do!

Note that the IRS does not:

The IRS has a dedicated Tax Scams webpage where the agency publishes warnings and updates about the current crop of scams that are being used.

- Demand that you use a specific payment method, such as a prepaid debit card, gift card or wire transfer. The IRS will not ask for your debit or credit card numbers over the phone. If you owe taxes, make payments to the United States Treasury or review IRS.gov/payments for IRS online options.

- Demand that you pay taxes without the opportunity to question or appeal the amount they say you owe. Generally, the IRS will first mail you a bill if you owe any taxes. You should also be advised of your rights as a taxpayer by visiting https://www.irs.gov/taxpayer-bill-of-rights .

- Threaten to bring in local police, immigration officers or other law enforcement to have you arrested for not paying. The IRS also cannot revoke your driver’s license, business licenses, or immigration status. Threats like these are common tactics scam artists use to trick victims into buying into their schemes.

The IRS has a dedicated Tax Scams webpage where the agency publishes warnings and updates about the current crop of scams that are being used.